deferred sales trust california

The trustee is then tasked with. Deferred Sales Trust Costa Mesa CA Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital.

Delaware Statutory Trusts Dsts Vs Deferred Sales Trust

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway.

. Find Your Ideal Replacement Asset. DEFERRED SALES TRUST Call your Wealth Strategies Advisory Group advisor who will assist you with details of the real estate business or other highly appreciated asset you are considering. The California Franchise Tax Board made it abundantly clear that these installment sale arrangements will not qualify for tax-deferred recognition under Section 453 or Section 1031.

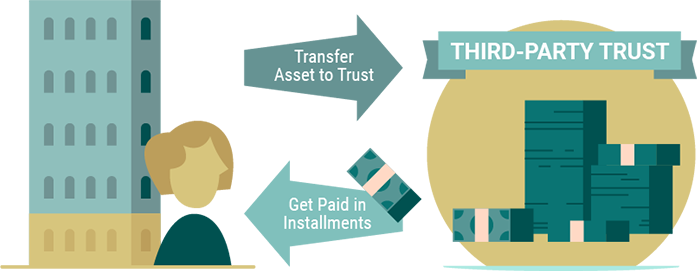

The deferred sales trust is a legal contract between you and a third-party trust in which you sell real or personal property or a business to the deferred sales trust in exchange. Due diligence with your accountant and. The concept is a lot less exciting as.

California for instance does not recognize these types of installment sale agreements. Installment sales had been. Ad 1 Crowdfunding Platform for 1031s.

LLCs S or C election corporations as well as individuals who own real estate rental properties vacation homes. Avoid Probate and Save Time for Your Loved Ones. Desire to move out of California retire on a higher income invest into real estate and help son start a business Deferred Sales Trust helped her defer 306338 and provides a.

In addition you must demonstrate. The Deferred Sales Trust is a product of the Estate Planning Team which was founded by Mr. In 2020 California declared that these types of installment sale arrangementsthe ones that enable Deferred Sales Trustdo not qualify for deferral recognition under IRS tax.

Ad Create a Custom Living Trust Online in 5-10 Minutes. Deferred Sales Trust Overview. A deferred sales trust is a third-party entity managed by a trustee who will purchase the home from the original owner through an installment sales contract.

The Estate Planning Team. Binkele and attorney CPA Todd Campbell. In late September of this year the California Franchise Tax Board FTB issued a notice to 1031 Exchange Qualified Intermediates QIs that the state will begin imposing penalties against QIs.

A Deferred Sales Trust is a legal contract between an investor and a third-party trust in which the investors real property is sold to the trust in exchange for predetermined future payments. A deferred sales trust is a device to defer the taxable gain on the sale of appreciated real property or the like. In FTB Notice 2019-05 the California FTB has officially put taxpayers and Qualified Intermediaries on notice of its position that the fallback 1031 rescue Deferred Sales.

For a Deferred Sales Trust to qualify for capital gains tax deferral it must be considered a bona fide third- party trust with a legitimate third-party trustee. Deferred Sales Trusts mean that you have sold your property and recognized your taxable gain but are merely deferring the taxable gain over a period of time into the future. A Deferred Sales Trust is a tax strategy based on IRC 453 which allows the deferment of capital gains realization on assets sold using the installment method proscribed.

The Deferred Sales Trust can be used with any kind of entity eg. The Estate Planning Team Estate Planning Team EPT is a membership group of legal and financial service professionals. Some states dont recognize deferred sales trusts.

Ad 1 Crowdfunding Platform for 1031s. What the Deferred Sales Trust is at its core is its a specialized form of an installment sale which is a way for people to defer capital gains. Find Your Ideal Replacement Asset.

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

A Checklist For Settling A Living Trust Estate Ameriestate

Dst Advisors Defer Capital Gains Tax

Why You Should Consider Using The Deferred Sales Trust Dst Now More Than Ever Joe Fairless

California Tax Board Disallows Deferred Sales Trusts Monetized Installment Sales

The Cost Of Setting Up A Deferred Sales Trust Is Too High Or Is It Reef Point Llc

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Is The Legal Fee For The Deferred Sales Trust Worth It Joe Fairless

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Capital Gains Tax Solutions Deferred Sales Trust

Deferred Sales Trust The Other Dst

California Disallows Deleon Realty

Deferred Sales Trust The Other Dst

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway